Ed Yardeni: Bull Market Alive and Well, S&P 500 Earnings to Hit $300 by 2026

Tech Stocks Still Hot, But Broadening Out Beyond the Sector

Yardeni: Don’t Fear Inflation, It Will Moderate

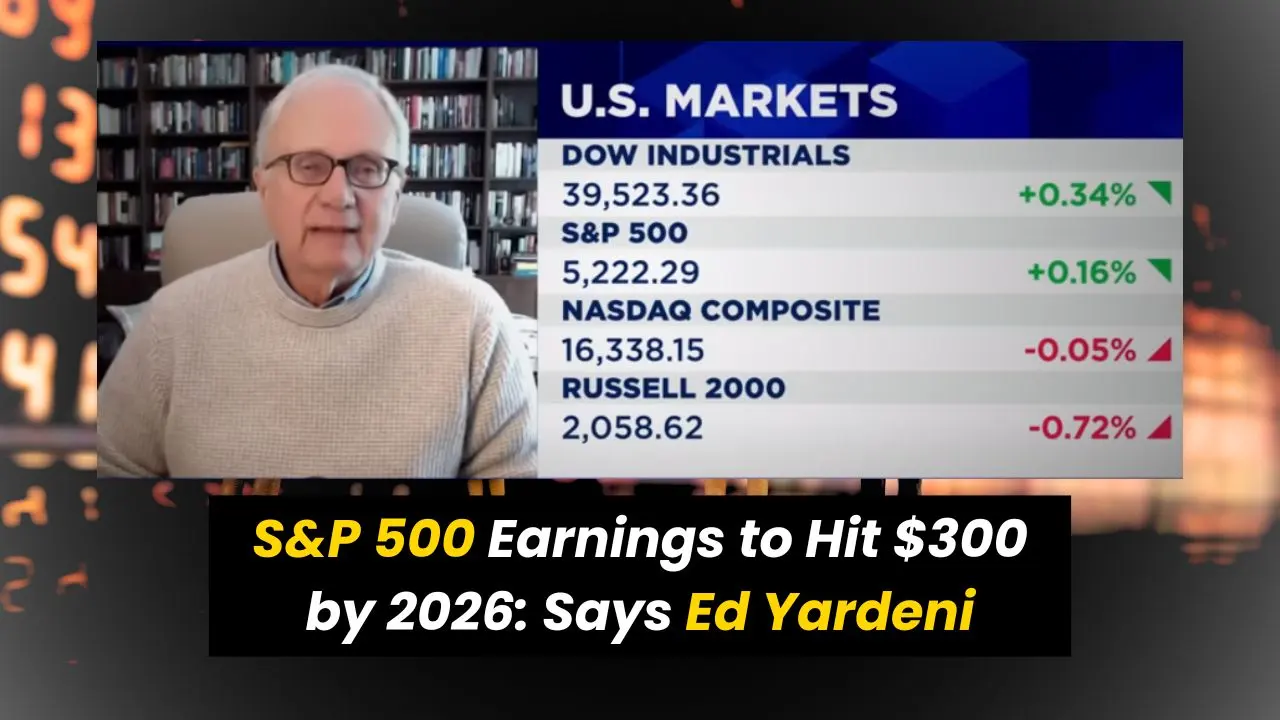

In a recent interview with CNBC, Ed Yardeni, the president of Yardeni Research, painted a rosy picture of the stock market, predicting a continuation of the bull market and even higher corporate earnings.

Here are some of the key takeaways from the interview:

Bull Market Here to Stay

Yardeni believes the current bull market is far from over, fueled by a positive economic outlook and moderating inflation. He expects the economy to keep growing, leading to a surge in corporate profits.

S&P 500 Earnings to Skyrocket

Yardeni is bullish on overall corporate profits, expecting them to reach $250 per share for the S&P 500 this year, a significant jump from current levels. He forecasts even higher earnings in the coming years, reaching $270 next year and a staggering $300 by 2026.

Profit Margins to Hit Record Highs

Yardeni predicts that profit margins will continue to expand, reaching all-time record highs. This suggests that companies will be able to squeeze more profits out of their operations, further boosting the stock market.

Tech Still Hot, But Other Sectors Join the Party

While Yardeni acknowledges the continued strength of technology stocks, he also sees a welcome trend of other sectors outperforming. He views this diversification as a healthy development for the overall market.

Also Read: Cryptocurrency Market Continues to Slide as Bitcoin Falls Below $61,000

All Stocks Are Tech Stocks Now

In today’s interconnected world, Yardeni argues that even non-tech companies rely heavily on technology for their operations. This suggests that investors shouldn’t shy away from non-tech stocks, as they are all indirectly benefiting from the tech boom.

Fed Should Hold Steady on Rates

Yardeni is comfortable with current interest rates and believes the Fed should maintain its current stance. He warns against the Fed lowering rates in response to any economic slowdown, as this could lead to an unhealthy market bubble.

Baby Boomers Fueling the Consumer Engine

Yardeni highlights the continued strength of the consumer, with baby boomers spending heavily in retirement. This strong consumer spending is a major driver of economic growth.

Also Read: Market Up as Investors Bet on Future Fed Rate Cuts? Cramer Reveals What’s Next

Younger Generations Face Challenges

While baby boomers are spending freely, Yardeni acknowledges that younger generations are struggling with consumer credit. However, he believes there is a strong sense of intra-generational support, with baby boomers helping out younger generations financially.

Overall, Yardeni’s interview offers an optimistic outlook for the stock market, with strong corporate earnings and a healthy economic backdrop. While there are challenges for younger generations, the strength of the consumer and continued technological innovation paint a bright picture for the future.

1 thought on “Bull Market Alive and Well, S&P 500 Earnings to Hit $300 by 2026: Says Ed Yardeni”