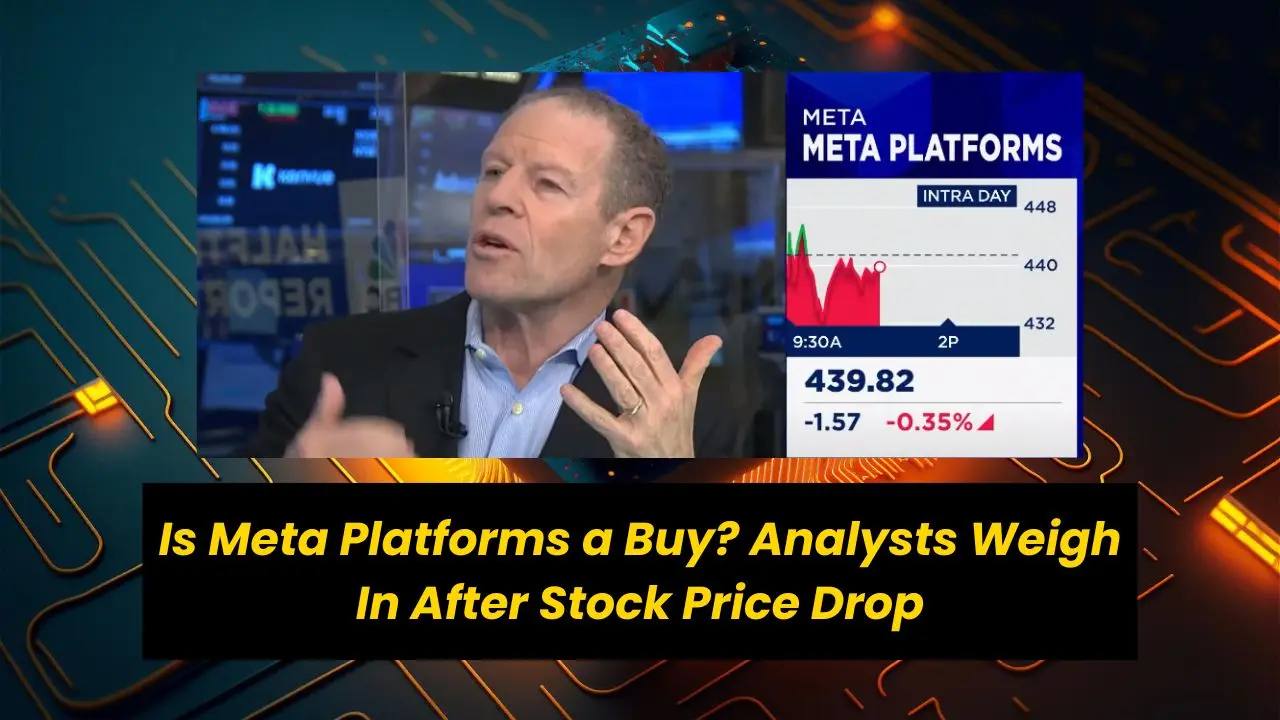

Meta Platforms’ stock price has been under pressure recently, but analysts are still bullish on the company’s long-term prospects.

Analysts talks about the future of Meta Platforms and its stock price. Jim Cramer mentions that while the Federal Reserve is likely to cut rates because the US economy is not doing well, this could hurt the stock market in the short term.

However, in the long term, the economy is expected to recover, and stocks like Meta Platforms are expected to do well.

Also Read: Nvidia Stock Soars on Upcoming Chip Releases: Analysts Bullish Despite Economic Concerns

Analysts talks about Meta Platform’s investment in AI and the development of new AI-powered advertising tools. These tools are expected to help Meta grow its advertising business and increase its revenue.

Analysts are mostly bullish on the company, with an average price target of $530.00, which is an upside of around 12.3% from where the stock is trading currently.

Also Read: Is AMD the Next Big Thing in Tech? Analysts Say Yes!

One analyst, Brad Erickson from RBC Capital, lowered his price target for Metastock from $600 to $570. However, he maintained a buy rating on the company. He believes that Meta can be an AI winner, but it needs to invest heavily in AI to do that.

Overall, the analysts are positive with bullish on Meta Platforms and its future. The company’s investment in AI is seen as a positive sign for its future growth.